The financial landscape is rapidly evolving, driven by innovation and technology that have redefined how we manage money. Traditional mobile banking, which once seemed revolutionary, now faces competition from digital wallets, a newer and more flexible way of handling finances. These changes reflect not only advancements in technology but also shifts in consumer preferences.

With future trends in mobile banking leaning heavily toward convenience, speed, and user-centric design, it’s essential to examine how these platforms stack up against one another.

Let’s explore the key differences between digital wallets and traditional mobile banking, their respective advantages and limitations, and what the future may hold for financial management.

Understanding Digital Wallets and Traditional Mobile Banking

Digital wallets and traditional mobile banking have fundamentally different origins and purposes, even though they share overlapping functions.

Digital wallets, like Apple Pay, Google Wallet, and PayPal, are software-based platforms that allow users to store payment information securely. They facilitate seamless transactions for purchases, transfers, and more, often integrating with broader ecosystems like e-commerce or social media apps.

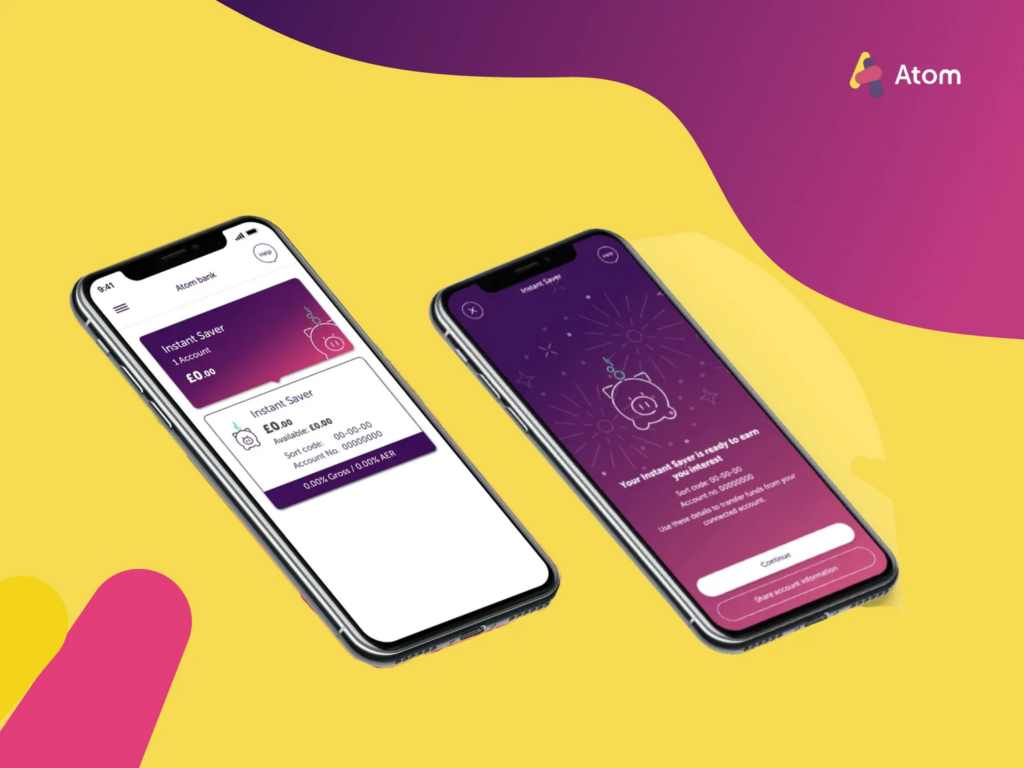

In contrast, traditional mobile banking apps are extensions of physical banks, offering account management, fund transfers, bill payments, and other core banking functions. Over time, these apps have adapted to include features like budgeting tools and remote check deposits, but their focus remains tethered to the services provided by a specific financial institution.

While both systems aim to simplify money management, their approaches differ significantly. Digital wallets are inherently transaction-focused and prioritize speed and simplicity, whereas traditional mobile banking apps are designed for comprehensive financial oversight.

Convenience: A Key Differentiator

Convenience is one of the most critical aspects shaping the competition between these two platforms.

Digital wallets excel in offering instant transactions. Whether you’re paying for a coffee, splitting a bill with friends, or shopping online, a few taps on your phone complete the process. Features like tap-to-pay and QR code scanning further streamline everyday transactions, making cash and even credit cards seem outdated.

On the other hand, traditional mobile banking provides a broader set of tools for managing finances, including viewing transaction histories, setting savings goals, and applying for loans. While these features are essential for long-term financial planning, the process can feel cumbersome compared to the agility of digital wallets.

The trade-off here is clear: digital wallets win in ease of use and speed, but traditional mobile banking offers a more robust and holistic view of one’s financial health.

Security: Balancing Innovation with Trust

When it comes to financial management, security is crucial. Both digital wallets and mobile banking apps implement cutting-edge security measures, but their approaches vary.

Digital wallets are built on advanced encryption and tokenization technology, ensuring that your payment information is not shared with merchants. Additional layers like biometric authentication (e.g., fingerprint or facial recognition) enhance security further. However, as digital wallets are often tied to third-party platforms, concerns about data privacy persist.

Traditional mobile banking apps, by contrast, benefit from the established trust and regulatory frameworks of the banking industry. These apps often require multi-factor authentication and offer fraud detection features. However, they can also be targets of phishing schemes and other cyber threats.

Ultimately, both systems are secure, but their vulnerabilities lie in different areas. Users must choose based on their trust preferences and risk tolerance.

Features and Integration

The competitive edge for both digital wallets and mobile banking apps lies in how well they integrate with broader technological ecosystems.

Digital wallets are increasingly expanding beyond payments, offering features like loyalty program integration, cryptocurrency support, and peer-to-peer transfers. For example, apps like Venmo and Cash App combine financial management with social elements, appealing to younger, tech-savvy users.

Traditional mobile banking apps are evolving, too, incorporating AI-driven tools to provide personalized insights, automated savings options, and even investment services. Partnerships with fintech companies are enabling banks to bridge the gap between their offerings and the more agile digital wallet platforms.

The line between the two is starting to blur as both adopt features from the other to stay competitive.

The Future of Financial Management

As technology continues to advance, the future of financial management will likely involve a convergence of these platforms.

Banks are embracing the principles of digital wallets, prioritizing simplicity and speed, while digital wallet providers are integrating features like budgeting tools and account management to compete with banks.

Looking ahead, future trends in mobile banking will be shaped by artificial intelligence, blockchain technology, and the demand for greater personalization. AI could revolutionize financial management by providing real-time insights and tailored recommendations, while blockchain may enhance transaction transparency and security.

The ultimate winner in this space will be the platform that strikes the right balance between convenience, security, and comprehensive functionality. Financial management is no longer just about managing accounts—it’s about creating an experience that seamlessly integrates into users’ lives.

Conclusion

The debate between digital wallets and traditional mobile banking isn’t about one being better than the other. It’s about understanding their unique strengths and how they can complement each other.

Digital wallets bring unmatched convenience for everyday transactions, while traditional mobile banking offers a more extensive suite of tools for long-term financial management.

As these platforms continue to evolve, the future of financial management will be defined by innovation and the ability to meet the diverse needs of users. For individuals and businesses alike, staying informed and adapting to these changes will be crucial in navigating this exciting new era of financial technology.